Quizlet Explain the Difference Between the Expenses

The policy attempts to match the revenues and expenses for these assets because the assets have a useful life of more than one year. Gain on sale of assets.

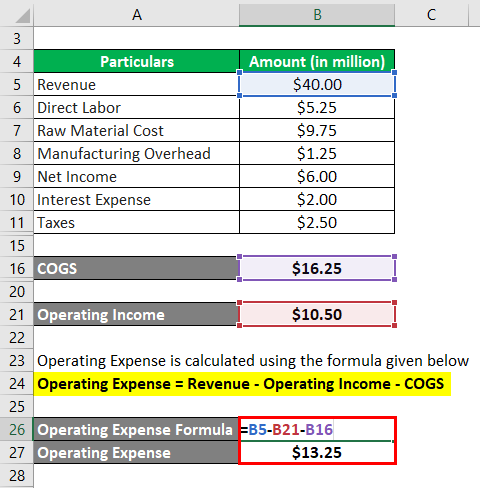

Operating Expense Formula Calculator Examples With Excel Template

Accrual accounting recognizes revenue and expenses as they occur whether or not payments have been made yet.

. An expense is an ongoing payment like utilities rent payroll and marketing. Example of fixed is rent and subscriptions examples of variable is gas and grocery. Why does the book value of an asset never go below the residual value.

Chapter 17 Problem 1CTQ is solved. -Adjustments involve increasing both an expense and a liability account. Memorize flashcards and build a practice test to quiz yourself before your exam.

Explain the difference between cost and expense. Start studying the Chapter 3 Accounting flashcards containing study terms like -Examples of accrued expenses are wages expense and interest expense. View this answer View this answer View this answer done loading.

Differences between IFRS and US GAAP The world allows two major frameworks for accounting in the whole world today. The main difference between cash-basis and accrual accounting is when revenue and expenses are recognized. Such expenses can be towards repairing and repainting of assets.

Which of the following is not a difference between an asset and an expense. The major difference between service and manufacturing industry. Fixed expense is consistentfixed same every month variable expense fluxuates month to month.

All assets with an estimated useful life eventually end up being exhausted. Manufacturing Industries engaged in the production of goods finished products that have value in. B Increase in assets is a debit entry whereas the increase in expenses is a credit.

Step 1 of 2. -They are reported on an income statement. Related Article Difference between Trial Balance and Balance Sheet Balance Sheet.

A An asset is recognized in the balance sheet whereas expenses are shown on the income statement. For example the expense of rent is needed to have a location to sell from to produce revenue. Different types of assets such as fixed intangible mineral assets are systematically reduced within their useful lifeThe difference between depreciation depletion and amortization depends on the type of asset in question.

Sale of goods commissions received sale of services etc. The basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement depreciation and the other is a contra. Rather than debiting an asset account which of the following statements explains an alternate recording procedure to journalize prepaid expenses such as prepaid rent or.

Variable Expenses Expenses that change due to demand for services such as seasonal demands crisis disaster ect. Typical household fixed expenses are mortgage or rent payments car payments real estate taxes and insurance premiums. The adjusted trial balance is prepared after adjusting entries have been recorded and posted.

Fixed expenses Expenses that do not change such as staffing costs rent or mortgage taxes ect. Let us look into the key differences between capital expenditure and revenue expenditure to develop a clear understanding of their functions in a business. The key difference between an expense and an expenditure is that an expense recognizes the consumption of a cost while an expenditure represents the disbursement of funds.

While you could theoretically change your monthly mortgage payment by refinancing your loan or by appealing your property tax assessment this is not an easy switch. Expenses show up on your business profit and loss statement. An example is a loss suffered from fire damage.

Gains result in an increase in assets or decreases in liabilities from peripheral activities. Explain the difference between a fixed expense and a variable expense include an example of each. However expenses occur in the normal course of operations whereas losses occur from transactions peripheral to the central activities of the company.

Capital Expenses Asset with a long life. Cornerstones of Managerial Accounting 6th Edition Edit edition Solutions for Chapter 2 Problem 1DQ. The same is true if you pay rent.

Difference between expenses and losses. An expense is usually recognized when a related sale is recognized or when the item in question has no future utility. Both expenses and losses are outflows of net assets.

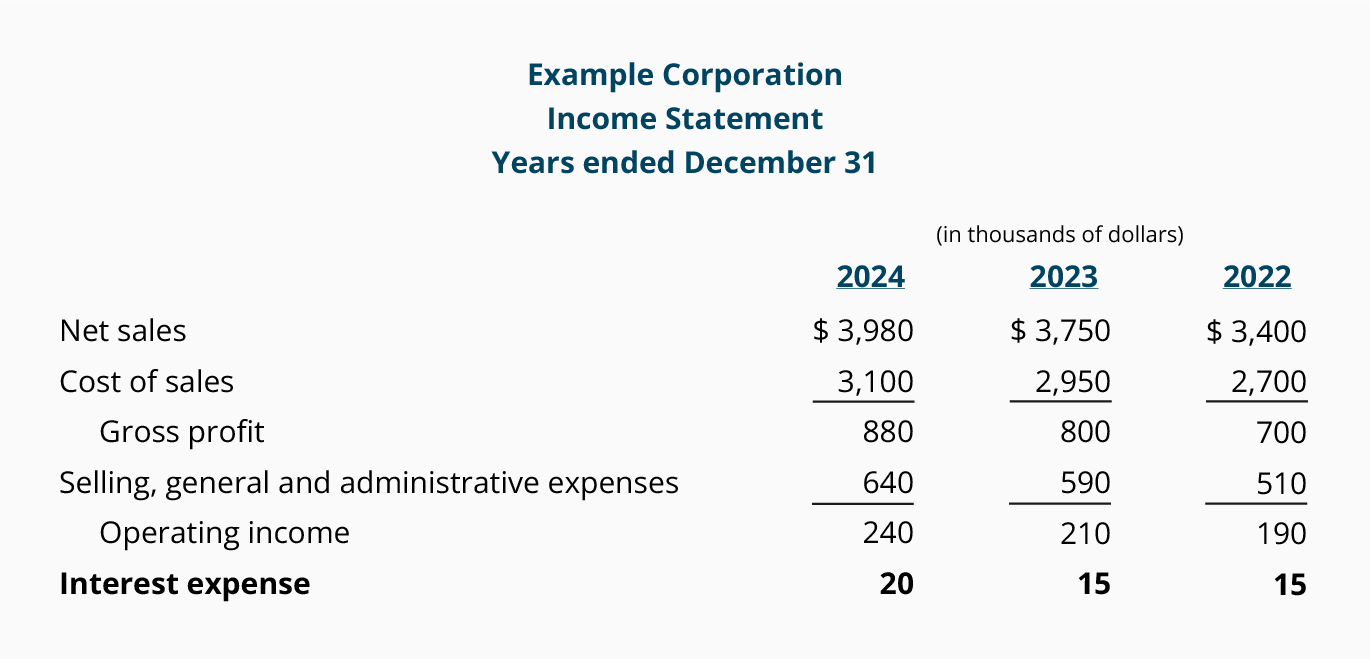

An income statement shows how profitsgains are earned and expenseslosses are incurred. The two frameworks have been constituted to create a harmony for accounting procedures globally. Explain the difference between the unadjusted and the adjusted trial balance.

A key reason why a cost is in practice frequently treated exactly as an expense. It consists of income and expenses. Difference between revenues and gains.

The difference between cost and expense is that cost identifies an expenditure while expense refers to the consumption of the item acquired. Depreciation Vs Depletion Vs Amortization. View a sample solution.

These terms are frequently intermingled which makes the difference difficult to understand for those people training to be accountants. What is the difference between depreciation expense and accumulated depreciation. Cash-basis accounting records these when money actually changes hands.

The balance of an account is transferred to the capital account in the balance sheet. Explain the differences and similarities between personal property real property intangible property and natural resources. Revenues are defined as increases in assets or settlements of liabilities from ongoing operations of the business.

You can also consider an expense as money you spend to generate revenue. The General Accepted Accounting Principles and the International Financial Reporting Standards are the two major frameworks.

How Do Net Income And Operating Cash Flow Differ

Tracking Mileage For Taxes Tracking Mileage Online Bookkeeping Accounting Software

Jean M S Free Wedding Checklist Is Waiting For You To Print Out And Include With Your Wedd Wedding Checklist Detailed Wedding Checklist Bridal Shower Checklist

Components Of The Income Statement Accountingcoach

4 Best Language Learning Apps Connecting The Dots Language Learning Apps Learning Apps Best Language Learning Apps

Acc 304 Midterm Flashcards Quizlet

15 Apps For Students To Stay Organized In College College Organization College Survival College Study

Pin By Anna Hendrix On Parties College Humor College School Humor

Accounting Made Simple Chapter 3 The Income Statement Flashcards Quizlet

Is College Worth It Scholarships For College College Survival College Planning

He420 Lesson 2 Exam Answers Ashworth College Exam Answer Exam Lesson

The Operating Expense Formula Fundsnet

13 Free Sample Training Attendance Sheet Templates Printable Samples Attendance Sheet Template Attendance Sheet Template Printable

Accounting Made Simple Chapter 3 The Income Statement Flashcards Quizlet

3 Types Of Expenses Fixed Periodic And Variable Be The Budget

Cma Part 1 Flashcards Practice Test Quizlet

Acc 304 Midterm Flashcards Quizlet

Hesi Math Flashcards Quizlet With Images Flashcards Math Flash Cards Chapter